Be sure to join me today, Dec. 5, to talk about the anatomy of Future Ready apologies — apologies that repair the kinds of collaborative relationships that you need now more than ever. 12:00 Eastern - https://www.linkedin.com/events/giveagoodapology-yourfutureread7270087185398136832/comments/

Today’s articles demonstrate a core reality of our present and future: externalities. In our Industrial Era upbringing (and in neoclassical economics — this book breaks it down nicely), we were taught that the externalities of our transactions didn’t really matter — economically, they were assume to sort of vanish. I tell the story of the externalities of my grandfather’s little paint factory in The Local Economy Revolution Has Arrived. As we learned 30 years later, the externalities of failed paint batches don’t go away on their own.

We know that, of course, but we often don’t act on that reality - we either ignore it, or we pretend we can’t see it. or we tell ourselves that it will be someone else’s problem.

From climate change to work teams, dealing with the externalities of our decisions - past and present - will play a prominent role in the post-Industrial era that is unfolding. It will consume our energy and money and resources, to be sure. But as these articles show, not dealing with them will cause even more problems. And as the last two articles show us, some of the most pernicious externalities we have to address lie in the work team meeting, and the home.

Too risky for insurance? Your house is basically a fireworks factory

** Note: this article is paywalled. If you do not have a Bloomberg subscription and have used up your free articles, you can access this via the r/politics subReddit. Just find the article, click the link and you will get a small number of additional Bloomberg articles. Given the paywall issue, I’m including longer passages from than article than I normally do.

We all know that places that are experiencing increased natural disasters due to climate change are losing conventional property insurers right and left. For homeowners who are cut out, one of the few available options is a “non-admitted insurer,” a provider with less regulations - and far less safeguards - than the typical insrance company.

… SURE is a type of lightly-regulated insurance known as “non-admitted,” largely absent in residential property until recently. Most insurance is highly supervised by the government, with states monitoring the quality of insurers, reviewing contracts and limiting price hikes. Conventional companies are backed by what is called a guaranty fund, meaning even if the company goes bankrupt, customers will still get their claims paid. Non-admitted companies have none of those protections. They’re more commonly found in the commercial real estate industry, and were designed for properties that face unique and relatively rare risks, like a fireworks factory or nuclear waste project.

But climate change is supercharging storms, floods and fires and making them more common. Conventional insurers are determining that houses in places struck often by extreme weather are too risky to insure, canceling hundreds of thousands of policies. In the last two years, seven of the 12 biggest home insurers have limited their coverage in California. For those whose policies have been dropped by major insurers, non-admitted insurance is one of their only remaining options for coverage. It means regular homes in some parts of the country are now viewed by the insurance industry as the equivalent of a fireworks factory.

Between 2022 and 2023, non-admitted home insurance premiums grew 27.5%, compared to 13.8% in the admitted market, according to data from S&P Global Market Intelligence.

Startups like SURE, Kin Interinsurance Network, and Orion180 Insurance Company are popping up across the country. But by some important measures, several of these smaller companies are not as financially sound as their more-established peers, or are structured in a way that makes steep price hikes likely. A Bloomberg Green analysis of some of the fastest-growing non-admitted insurance companies found: growing losses in the tens of millions of dollars for multiple years straight, little capital, huge dependence on reinsurance (insurance for insurers) and low or no ratings from AM Best, the largest and most trusted insurance rating agency in the world. It adds up to an increasingly checkered landscape that insurance brokers and homeowners must wade through with new caution.

Women and the burden of invisible labor

https://rianeeisler.com/revisioning-the-economic-rules-empowering-women-and-changing-the-world

This article is three years old but just came to me via the Bioneers newsletter. As a working mother, the experiences described in this article definitely resonated, but when I was fighting my way through that period of my life, I never understood that a big part of the burden came from the fact that my child care and household fell outside of the economic value system, and thus were consistently overlooked and undervalued.

Riane Eisler, however, had no such problem in this essay:

So I want to invite you to join me in something we hear a great deal about: in thinking outside the box of conventional economic systems, whether capitalist or socialist, and begin to envision and help create a new economic system – economic measurements, models, and rules that no longer are conceived without taking into account the female half of humanity; indeed, without taking into account the humanity of either men or women; an economic system that takes into full account the real value of the most basic and important human work: the work of caregiving – of caring for children, the sick, the elderly – work without which there would be no workforce, work without which none of us would be alive – work that has traditionally been relegated to women, and is still considered inappropriate for so-called “real men,” work that must be taken into full account if we are to stop being on the periphery, if we are to become truly economically empowered. [….]

I want to close by focusing again on six levers, six interventions, for fundamental systemic change:

1. Demonstrate the social and economic benefits of policies that support caregiving, and their urgent necessity in the postindustrial age.

2. Employ a systemic approach, including a concerted campaign to end violence against women.

3. Envision and create a partnership economics that no longer devalues women and stereotypically feminine traits and activities, such as caregiving, nonviolence, and empathy.

4. Change economic measurements such as GDP to include the work of caregiving stereotypically relegated to women

5. Develop, support, and disseminate partnership economic inventions such as paid parental leave that give visibility and value to caregiving – whether it is performed by men or women.

6. Expand women’s role in policy making and form alliances to work together with one another, as well as with men – locally, nationally, and internationally – to bring women’s issues to where they belong: from the back to the front of the political and economic agenda.

The entire article is quite long, but well worth a read. Rethinking and re-calibrating how we value - and account for - the work of child care, elder care and home care is not only essential to justice and equity, but it’s something we’re going to have to do.

Because the externalities created by these shortsighted choices are weighing us down, and they will get worse, not better.

The risk within our organizations - and our heads

Stowe Boyd’s workfutures newsletter is one of the best out there, and nearly every issue gives you quotes, insights and more that get to the deepest issues facing us at work. Stowe’s most recent newsletter includes a powerful article on the risks — really, the externalities — of the uncertainty, volatility and ambiguity that impacts nearly every aspect of businesses and organizations today

We have already entered the postnormal, where the economics of the late industrial era have turned inside out, where the complexity of interconnected globalism has led to uncertainty of such a degree that it is increasing impossible to find low-risk paths forward, or to even determine if they exist.

The deepest risks may not be in the marketplace or what's happening outside the organization -- the rising inflation curve, the competitors adopting new technologies, the new virus emerging in a South Asian bat -- but instead, in the behaviors baked into organizations so deeply that they can't be spoken of.

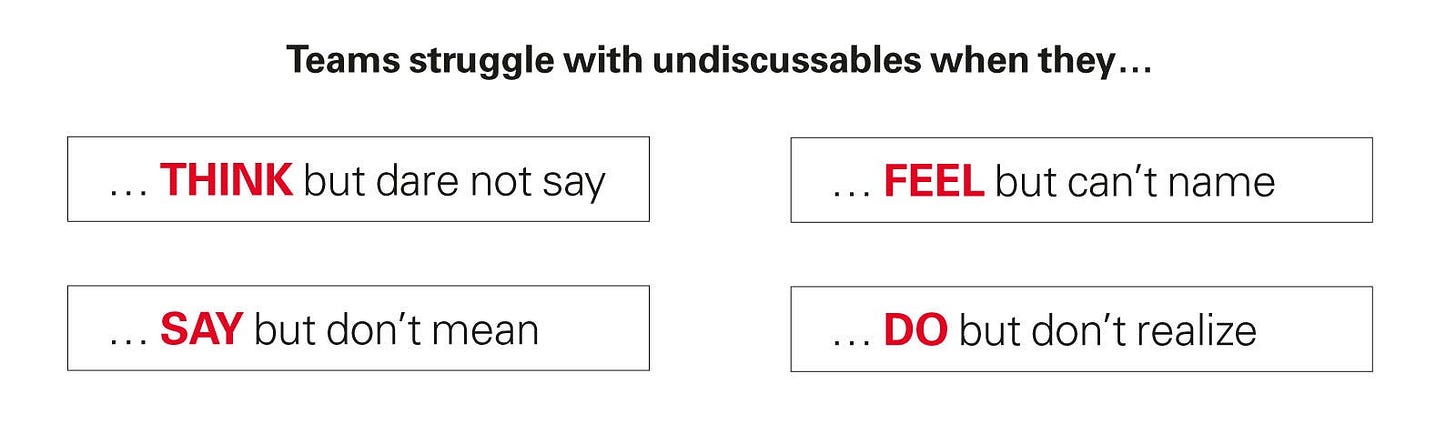

The best response to increasing ambiguity is to reevaluate premises that may be invalidated by various scenarios made more likely by shifting risks. This requires unthreading the various kinds of undiscussables:

You think but dare not say. This self-censorship arises when people fear the consequences of speaking about something openly, which is indicative of erratic management who respond to attempts at frank discussion and criticism with harshness. The fix is to change the culture to eliminate the threat of retribution for speaking openly about the undiscussable.

You say but do not mean. Here we have spoken untruths, the mirror image of truths unspoken. Toegel and Barsoux relate the story of a paper company whose leadership embarked on a 'company reinvention' in response to plunging demand due to the rise of the digital world. However, at retreats and protracted meetings the initiative seemed focused only on cost-cutting and greater efficiencies. It was only after several rounds of downsizing that the CEO realized the hypocrisy of this 'reinvention', and responded by turning the problem of reinvention over to a larger, younger, more diverse group with greater experience outside the paper industry, who eventually developed a successful plan to shift into a renewable materials company.

You feel but cannot name. Negative feelings that may not be expressed openly -- like distrust of a manager by team members -- doesn't stop the feelings from being manifested in non-spoken ways. It may be painful, but the solution is to name the issues and work out some truce, and -- as in warfare or counseling -- this may require neutral third parties to mediate.

You do but do not realize. As the authors state, "The deepest undiscussables are collectively held unconscious behaviors. These undiscussables are the most difficult to uncover." These are often caused by anxiety among a group causing avoidance or defensive routines that reduce anxiety in the short-term, but then in the long-term derails learning new behaviors or attacking the root cause of the anxiety.

Heightened uncertainty, risk, and ambiguity are perhaps, as Georgieva said, the defining theme of our time. The first step with uncertainty is to try to gauge it, and once it is quantified, try to identify scenarios that might occur so that responses can be planned and employed when necessary. But the deepest risks may not be in the marketplace or what's happening outside the organization -- the rising inflation curve, the competitors adopting new technologies, the new virus emerging in a South Asian bat -- but instead, in the behaviors baked into organizations so deeply that they can't be spoken of.

Once we harden in our collective thinking, cease to question our core assumptions, and censor those who raise the most undiscussable issues, then we have lost our path through the fog.

[Emphasis mine]

I think I am being haunted by that last sentence.